Navigating the complexities of retirement planning can be a daunting task. With the recent introduction of the Secure Act 2.0, there are significant changes that you need to be aware of, especially if you’re concerned about your beneficiaries. As your trusted advisor, I’m here to guide you through these changes and ensure you and your loved ones are well-prepared for the future.

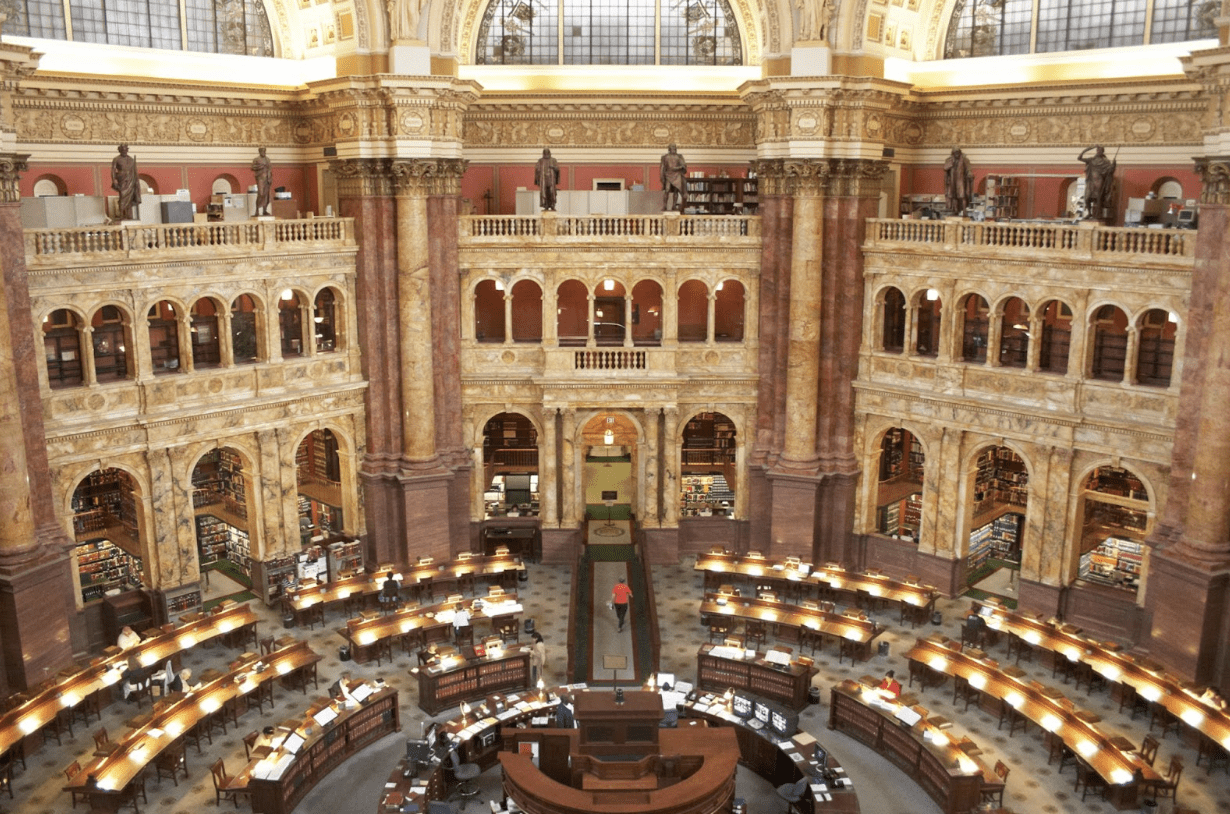

Understanding the Key Points of Secure Act 2.0

The Secure Act 2.0 brings several changes to the retirement system, each aiming to provide greater flexibility and opportunities for retirement savings:

Changes in Catch-up Contributions: Starting January 1, 2025, individuals aged 60 to 63 will be able to make catch-up contributions of up to $10,000 annually to a workplace plan. This amount will be adjusted for inflation.

Changes in Required Minimum Distributions (RMDs): The age to begin taking RMDs has increased to 73 in 2023 and will rise to 75 by 2033. Additionally, starting in 2023, the penalty for not taking an RMD decreases to 25% of the RMD amount not taken, and 10% if corrected in a timely manner for IRAs.

RMD Exemption for Roth Accounts in Employer Plans: Starting in 2024, Roth accounts in employer retirement plans will be exempt from RMD requirements.

Defined Contribution Plans and Emergency Savings: An emergency savings account associated with a Roth account will be added starting in 2024.

Assistance with Student Debt: Starting in 2024, employers will be able to “match” employee student loan payments with corresponding payments to a retirement account.

How Secure Act 2.0 Impacts Your Beneficiaries?

With the Secure Act 2.0 coming into play, there are critical implications for your beneficiaries:

Stretch IRAs: Most non-spousal beneficiaries now must withdraw all assets from an inherited IRA within ten years. This change could have significant tax implications.

Elimination of Age Limit for Contributions to Traditional IRAs: Older individuals can now continue contributing and building their legacy for their beneficiaries.

Contributions to Roth Accounts: Starting in 2026, if you earn more than $145,000 in the prior calendar year, all catch-up contributions to a workplace plan at age 50 or older will need to be made to a Roth account in after-tax dollars.

Maximizing the Benefits of Secure Act 2.0 for Your Beneficiaries

Given the Secure Act 2.0, having a strategy is essential. Here are some steps:

Review Your Estate Plan: Check and adjust your estate plan to align with the new rules and optimize potential tax benefits.

Consider Roth Conversions: With the shortened timeframe for distributions for non-spousal beneficiaries, converting traditional IRAs to Roth IRAs might be strategic.

Open Communication: Discuss these changes with your beneficiaries so they are informed.

In conclusion, while the Secure Act 2.0 introduces several significant changes, with proper planning, you can ensure a prosperous future for you and your loved ones. As always, I am here to help you navigate these waters and make the best decisions for your unique situation.

Contact Us! We Understand Finance And Trust.

Our Streetlight Financial Offices in Massachusetts and Vermont.